OPPO could start introducing phones with custom silicon, but it has a long way to go before challenging Qualcomm.

When talking about Android silicon, the triumvirate of Qualcomm, Samsung SLSI, and MediaTek dominate the conversation. Huawei's HiSilicon used to be a big player as well, but the U.S. government's bans have effectively killed off its custom hardware ambitions. And while Google made its debut in this category with its Tensor design in the Pixel 6 series, the phones are limited in global availability. So they just won't be sold in anywhere near the kind of figures as most major Android brands.

For disruption in this category, we'll have to look at what OPPO, Vivo, and Xiaomi are doing. These Chinese manufacturers have the scale (and the money) needed to kick off their custom chipset ambitions. Although we've seen a few efforts already, such as Xiaomi's Surge S1 and Vivo's custom imaging module in the X70 series, they have been initial forays.

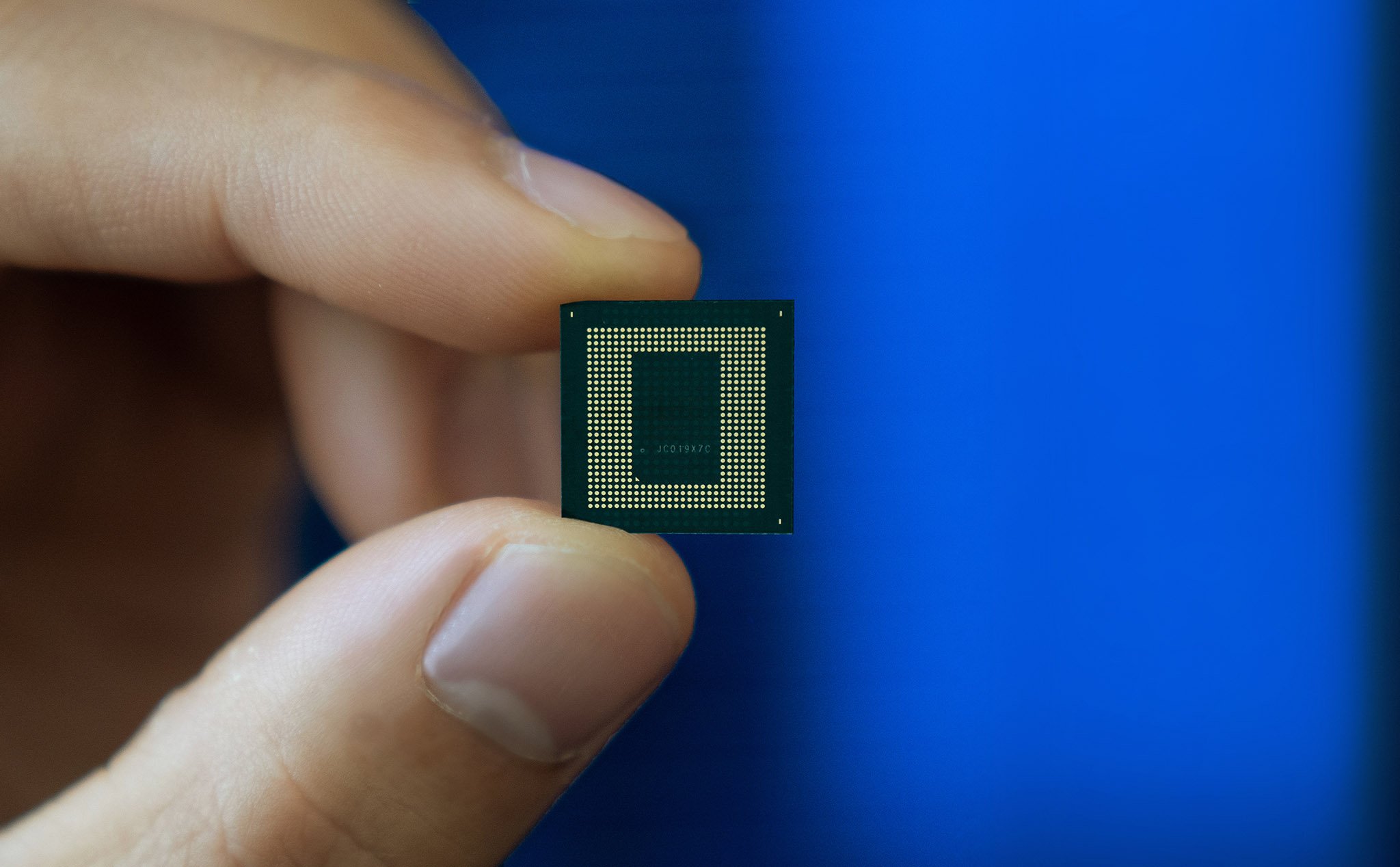

With OPPO signaling interest in building custom chipsets, it's worth looking at just how that might work and if the Chinese manufacturer will do anything differently. Mobile silicon is at a point where it's not just the CPU and GPU cores. It's also a lot of additional components that include: dedicated cores for machine-learning and on-device AI models; cellular and Wi-Fi modems with the latest connectivity standards; the associated RF front-end modules; and standalone ISPs for delivering standout photos.

In short, a lot of work goes into making a mobile SoC, and that's why not many phone manufacturers decide to go down this route. But, that said, it's looking more and more likely that we'll see further differentiation in this segment.

Sravan Kundojjala, director at Strategy Analytics, told Android Central that there's a lot of historical precedence for the same.

"Historically, Nokia, Motorola, Ericsson, BenQ-Siemens all tried their hand at designing their own basebands for in-house usage. In the last decade, Apple, Huawei / HiSilicon, and Samsung drove this trend further," Kundojjala said.

There are a lot of inherent advantages to building a chip in-house. For one thing, vertical integration allows manufacturers to tailor the hardware to the software better, and no one does better than Apple. For example, the A15 Bionic in the iPhone 13 Pro Max offers incredible performance and has the fastest single- and multi-core scores of any mobile solution around. But there are other factors at play.

"Vertical integration offers multiple advantages: control over the supply chain, tight integration between software and hardware, immunity from geopolitical battles, and price negotiation leverage," Kundojjala said.

OPPO and Xiaomi have the scale to start investing in custom silicon.

Why don't more brands do it then? It's all down to money. It's not easy to come up with a custom chipset design — particularly with AI use cases and multi-gig Wi-Fi and 5G becoming a reality — and it's a sizeable investment that won't bear fruit for several years; if at all. However, with Xiaomi being the world's largest phone manufacturer and OPPO in fourth, Kundojjala notes that they now have the scale to differentiate their offerings with custom hardware. "OPPO and Xiaomi have now gained significant scale, which can help them sustain their chip investments and differentiate their products."

One out of four phones sold globally comes with an in-house SoC, so Chinese brands have many incentives to get in on the action. "Strategy Analytics estimates that vertical vendors will account for 25 percent of all smartphone application processors shipped in 2021, down from 37 percent in 2020. This is due to HiSilicon's forced exit due to trade restrictions."

While there's precious little in the way of details, we can make a few guesses about what OPPO's custom chipset plans would look like. The company would want to focus on the high-end category because that's where differentiation will matter the most. We've already seen OPPO do a lot of innovation in terms of designs with mechanized camera modules and cutting-edge lenses, so it's natural for the brand to further that differentiation with its own silicon.

As for the building blocks, OPPO and other Chinese brands are likely to license Arm's designs, just like Qualcomm and Samsung.

"OPPO and Xiaomi will leverage Arm's CPU IP and TSMC's leading-edge process technology to design their chips," Kundojjala said.

But while that should be straightforward enough, Kundoljjala explained that these brands also have limitations when it comes to connectivity.

"OPPO and Xiaomi do not have a lot of experience in designing chips and do not have all the IP blocks necessary," he said. "For example, both brands currently lack 5G modem technology. So, they have to develop that first and integrate 5G modem into their premium tier chips."

It's this lack of modem technology that will limit new entrants. Even Google is using Samsung's existing 5G modem in the Tensor chipset, and for all of its might, Apple doesn't design its own modem either — it uses Qualcomm's 5G tech in iPhones.

"Modem technology is critical to succeeding in smartphones. Even Apple had to acquire 5G modem technology from Intel and now Qualcomm," Kundojjala said. "OPPO and Xiaomi are likely to design 5G chips, but it will take a lot of time to match the performance of Qualcomm and MediaTek."

Ultimately, Qualcomm has an unassailable lead when it comes to 5G modem tech.

Kundojjala pointed out that while Chinese manufacturers made headway in designing their own ISPs, they're lacking in other areas, including an "AI engine, security engine, and multimedia engine." So when coming up with a custom design, OPPO will likely have to team up with Qualcomm, MediaTek, or another vendor to integrate these parts.

Another reason brands like to build their own custom silicon is to reduce reliance on other vendors. Huawei's tribulations are proof of that. However, Kundojjala added that escalating tensions between the U.S. and China could hinder these brands, limiting their access to foreign technology.

So, where does that leave us? OPPO is likely to build its own silicon for an upcoming high-end phone in the coming years, but it's unlikely such a device will make its way outside China — at least at first. Instead, Kundojjala posits that the initial focus will be on the Chinese market, where the brand sees an overwhelming majority of its sales. That reasoning plays out when we look at what Xiaomi and Vivo have done in this category to date.

One thing's for sure, though: Qualcomm doesn't have anything to worry about.

"Qualcomm has lived with Apple and Samsung for years without losing its business. Samsung, for example, uses Snapdragon chips in 40 to 50% of its Galaxy S devices," Kundojjala said. "Samsung, despite its years of experience in chip design, gives a lot of business to Qualcomm. Also, Qualcomm has other assets such as RF front-end (RFFE), which is difficult to replicate for OPPO and Xiaomi."

Chinese manufacturers account for over 40% of Qualcomm's semiconductor revenue today, and according to Kundojjala, that isn't likely to change anytime soon. So even if these manufacturers introduce custom silicon, they will have to work with Qualcomm to deliver 5G connectivity and AI-enabled use cases on par with the best Android phones. So, for now, it doesn't look like the status quo is changing in the semiconductor industry.

Source: androidcentral