Editor’s note: Get this weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7am PT), just subscribe here.

Commercial real estate, the traditional heart of most cities, may have lost its reason to exist in the last few months. The world is about to find out what the situation is as more locations start to reopen.

First up in our ongoing coverage of the topic, Connie Loizos caught up with a couple proptech investors this week for TechCrunch, who saw existing trends accelerating — with many medically focused additions.

Brendan Wallace of Fifth Wall is looking for more aggressive pickup of smart tech in general, along the lines of what you already see in some other countries. “He notes sensors that can determine how many people are in a room or pass through a turnstile. He points to facial recognition tech that can help keep points of physical contact to a minimum. He imagines that more companies might embrace robots to patrol buildings and, possibly, to clean them, too.”

Darren Bechtel of Brick and Mortar saw tech remaking the construction site, with growing practices like using large-scale pre-fabricated components: “If you’re limited by how many people can work in the field, and you have to put in controls for people not working on top of each other, the question becomes: how can you do the work in a more controlled environment, with a next-gen HVAC system [to purify the air] and markings on the floor?…. People are now saying, ‘How much can we prepare off-site?’”

Buildings are also going to be focused on health features, Connie wrote. “[B]oth Wallace and Bechtel mentioned advanced air purifiers and air handling units used to recondition and circulate air as part of a heating, ventilating and air-conditioning plan. Both say it will likely become a growing area of interest for building owners and developers.”

What about beyond the buildings? A few writers here put together some thoughts in a post for Extra Crunch. Here’s Danny Crichton’s view from Brooklyn:

Few of us can live in the dreary confines of a suburban enclave our entire workweek. And so I expect to see a revitalization of the classic Main Street clusters that once dotted towns across America as people appreciate the close proximity of amenities that they need throughout their day and remote work makes it possible to skip the commute to the central business district.

It’s not going to be a simple transition, of course. The built environment alone will probably take decades to fully transition. But the spirit of Jane Jacobs lives on and will move beyond the downtown core neighborhoods she observed to spread to medium and perhaps even small towns across the country and throughout the world.

If you want more on the topic, check out our recent investor survey with six other top proptech investors from late March (for subscribers).

Just want to settle down at home and get to work? Check out Darrell Etherington’s TechCrunch guide to setting up a pro-grade videoconference studio.

The $100M ARR club continues to grow, despite everything

When Alex Wilhelm rejoined TechCrunch late last year, he kicked things off with a list of companies that he called “the $100M ARR club” to signify unicorns that were also generating a lot of revenue. It was a clever way of organizing which of the hundreds of highly valued companies heading towards IPOs were most set up for success, and our readers agreed.

But, with entire market categories whipsawed by the pandemic, it has been hard to find companies willing to share numbers lately. He still found a few, as he wrote up for Extra Crunch this week: ActiveCampaign, Recorded Future and ON24. Here’s a vignette from the CEO of ActiveCampaign:

While we had the CEO’s attention, TechCrunch wanted to know if ActiveCampaign was taking incoming fire from COVID-19 and its related economic and labor disruptions. As some other SMB-focused software companies have told us, the answer is no. Here’s [Jason] VandeBoom:

We anticipate continued growth in 2020 and are already seeing further acceleration to support this. The past four months have been the best in company history and we’ve seen monthly trials double in that timeframe and new customer acquisition numbers at 4500, 5500, 6000 and 7000 respectively from January to April.

He did hedge those results a little, adding that while his firm has “seen some acceleration from COVID-19 and the digital transformation that it is inspiring,” the CEO is more convinced that “the need for customer experience is what is fueling the majority of this growth.”

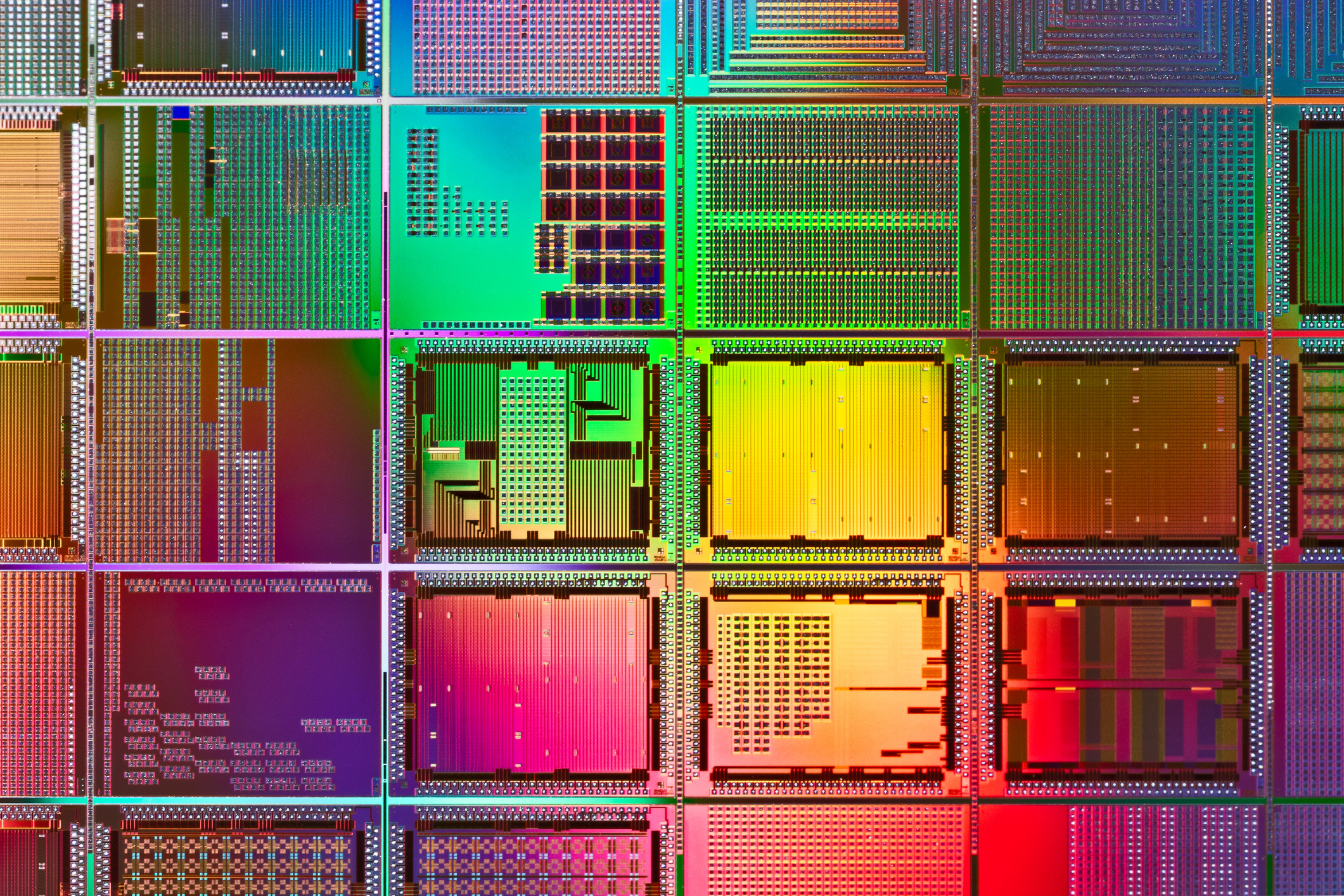

This week in China trade news….

The already basic trade agreement between the Trump administration and the Chinese government from last year looks ready to blow up; the administration banned selling more tech to Huawei; TSMC plans to open a factory in Arizona following urging from the US government; Foxconn profits crashed… Danny Crichton has a clear takeaway on TechCrunch for startups about the latest headlines:

[T]he world of semiconductors, of internet infrastructure, of the tech ties that have bound the U.S. and China together for decades — they are frayed and are almost gone. It’s a new era in supply chains and trade, and an open world for new approaches to these huge existing industries.

If your company is not already planning for a more chaotic, multi-polar world than what most of us can remember living through, it may already be too late.

(Photo by CHRISTOPHE ARCHAMBAULT/AFP via Getty Images)

Investor survey: hospitals to increase tech focus after pandemic

Sarah Buhr talked to top investors in the healthcare B2B and infrastructure businesses for one of our investor surveys this week on Extra Crunch. They generally seemed to agree that the pandemic was going to push the system wholesale towards better technology. Here’s Bilal Zuberi of Lux Capital:

While a lot of our healthcare infrastructure will take a little bit of time recovering from the stress COVID placed on it, we anticipate this to provide a push to the system to adopt new technologies that enable distributed health, build resiliency in our delivery networks and deploy data-enabled healthcare. Hospital balance sheets might struggle in the short term to buy new technologies, but payers as well as large businesses might participate in infrastructure development and deployment in a bigger way. We anticipate selling to hospitals to be difficult in the short term, as they try to recover from the revenue shortfall they experienced during COVID-19, but will generally emerge more interested in adopting new technologies, digital and remote health solutions and automation in various functions. Needless to say, a wide-scale digital transformation of our healthcare industry is underway, and there is no looking back.

Don’t miss our other survey this week, on how the mobility investors are viewing the pandemic.

Protecting your equity as a startup employee

Wouter Witvoet of fintech startup SecFi wrote a guest post for TechCrunch going over some key points for anyone working at a startup right now (or recently). As an occasional startup founder and/or employee myself, I’d like to recommend this one for special consideration: “Negotiate for equity during a pay cut or furlough.”

Startups typically offer equity as a means of deferred compensation and as a way to incentivize employees to own a piece of the company they are building. The compensation is deferred as most startups are cash-strapped and cannot afford to pay you what a larger company may be able to.

If your company is now asking you to take a pay cut, or even take no pay during this time, you should consider asking for additional equity to make up for the lost compensation. While not all companies may be amenable to offering more equity, there is no cash outlay from the company’s standpoint, so it’s an efficient way for your company to compensate you for your sacrifice while preserving their cash.

In addition, offering more equity shows a commitment from management to their employees during this difficult time. It may be the win-win scenario for your company and yourself in the long-run so it’s worth having the conversation with management to discuss if this is available for you.

At first it seems weird when you consider typical venture dynamics. The founders have probably already lost leverage against the company’s investors. These investors have probably already lost leverage against their LPs. So nobody is naturally included to give up even more. And the employees were already last in line on the cap table and first to go, so why should founders do anything different?

Tactically, the best employees will be attracted go work at bigger more stable companies as the pandemic recession stretches on — and you might not have the cash to afford the effort to rehire. Strategically, now is the time to build the esprit de corp that will carry your company forward into better times… a few extra basis points for the team now could help deliver a priceless return.

Across the week

TechCrunch

COVID-19 shows we need Universal Basic Internet now

AngelList wants to improve comparing VC fund performance with new metrics and calculator

Where to shop online that isn’t Amazon, Target or Walmart

Extra Crunch

4 edtech CEOs peer into the industry’s future

Sequoia’s Roelof Botha is more optimistic about startups today than he was a year ago

These best practices maximize the value of your online events

Fintech startups amass war chests for the economic downturn

Around TechCrunch

Give the gift of Extra Crunch membership to anyone

Extra Crunch Live: Join Alexia and Niko Bonatsos for a Q&A May 19th at 2 pm EDT/11 am PDT

Extra Crunch Live: Join Revolution’s Steve Case and Clara Sieg on May 21 at 3pm ET/12pm PT

#EquityPod

From Alex:

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Are you a regular Equity listener? Take our survey here! We talk about it on the show.

From home once again this week, Danny, Natasha, Alex and Chris got together to pull the show together. But unlike last week’s episode (catch up here if you are behind), this week’s show features a game that actually worked. It’s at the end, as you’ll see.

But before that piece of the puzzle, there was a bunch of news to go over. We had to leave SaaS valuations, the Liftoff List, Brex and FalconX on the floor, but there was still so much good stuff to cover:

- Slice raised $43 million from KKR, making us all rather hungry — and curious. Where does Slice fit into the food-delivery market, and does its restaurant-friendly model give it enough room to grow revenue so that its new valuation makes sense?

- The Uber Eats-Grubhub deal was an unavoidable topic this week, given that it has the chance to remake the food delivery landscape. What room would be left in the market for Postmates? And would it pass regulatory scrutiny? We’re curious.

- Sticking to the on-demand theme, Instacart has grown bonkers-quick in the last few months, even making some money in the process. We’re impressed.

- It’s not the only thing out there growing like hell — Shopify is also putting up insane numbers, as reflected in its share price. TechCrunch took a look back through its history the other day.

- The secondary markets saw some consolidation this week, which brought back some fond memories.

- Quizlet raised $30 million at a $1 billion valuation, causing some consternation among the hosts. And Vise raised a more modest $14.5 million in a round that Danny covered.

Then we played our game. Please hold us to account. And if you have listened to the show for a while, take our survey! It’s right after this next sentence.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Source: https://ift.tt/369JqW3