It's time for Wear OS to shine, and experts say more manufacturers are going to adopt it moving forward.

The best decision Google made was partnering with Samsung on Wear OS, a much-needed move for the operating system that many people complained about, experts say. However, they have mixed thoughts on why Samsung saw its highest quarterly smartwatch shipments, per a recent report.

Published on Nov 22, Counterpoint Research notes in its report that Samsung achieved its highest quarterly shipments with the launch of the Galaxy Watch series, "narrowing the gap with Apple."

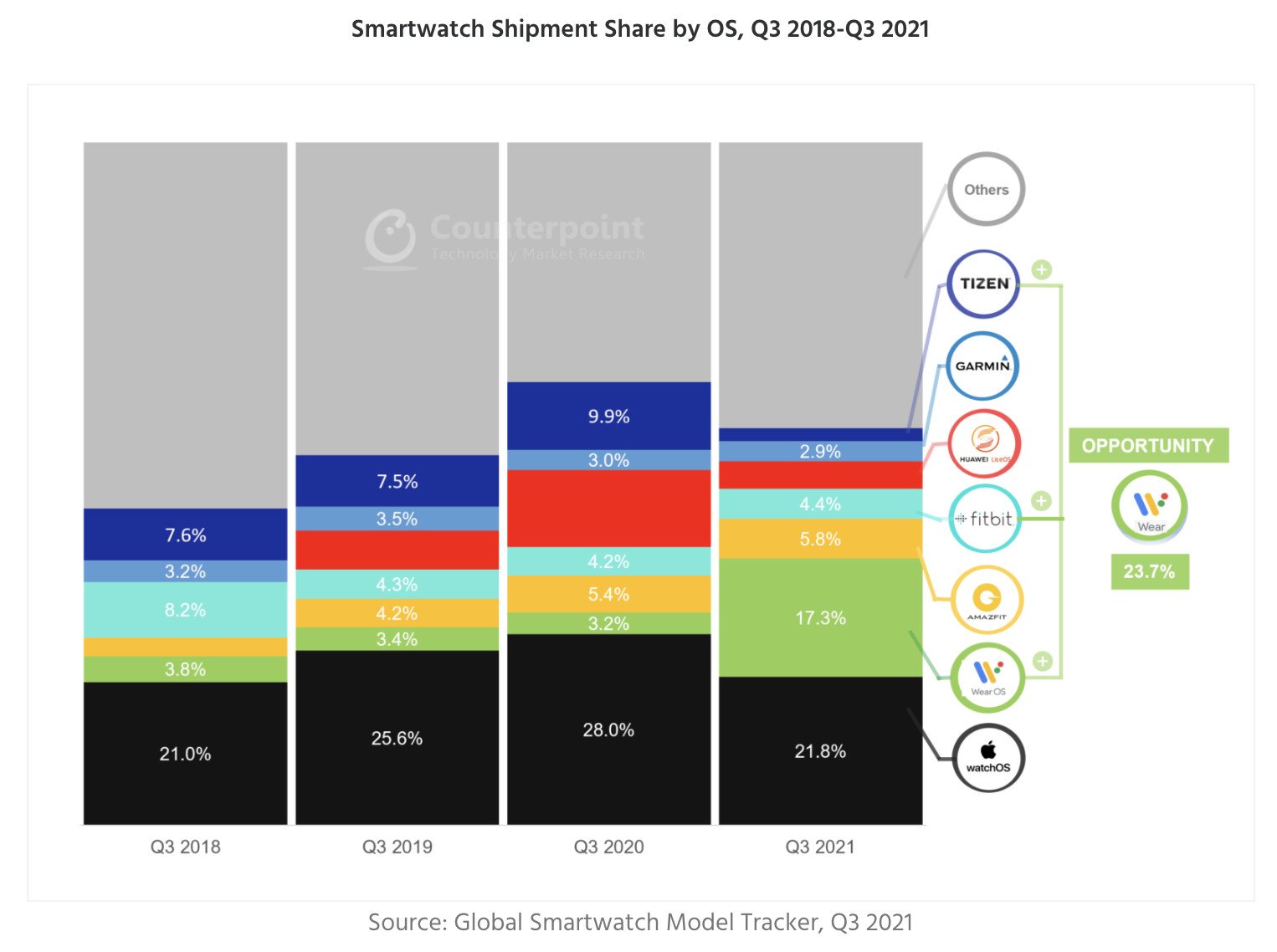

"With Samsung's move to use Wear OS, the OS's share in the smartwatch market increased to 17% in Q3 2021 from 4% in Q2 2021," the report says.

Overall global smartwatch shipments in the third quarter this year increased 16% compared to the same period a year ago. The report notes that the Wear OS market share grew to 17.3% in Q3 2021, up from 3.2% in the same period a year ago.

Counterpoint's senior analyst Sujeong Lim says in the report that Samsung performed better than expected and that shipments of the Watch 4 series were much higher than expected.

Google has maintained a dominant share in the smartphone market with the Android OS, but so far has not achieved much in the wearable market. This is because Google controlled smartwatch OEMs from customizing the UI, and it was not chosen by them due to its lower power efficiency and slow response time. However, the partnership with Samsung from this year has gained a foothold for Google to expand its presence in the wearable OS market and seems ready to transform into a more open wearable platform from this time forward. — Counterpoint's senior analyst Sujeong Lim

Google and Samsung announced the partnership in May, and the Galaxy Watch 4 is the first smartwatch to run Wear OS 3.0; it is also the best Android smartwatch you can buy right now. Google later highlighted that there would be several improvements and updates to its Wear OS apps and services, reminding the world that while Samsung makes the watch, it still controls the ecosystem.

Google likely understands that Wear's growth potential was limited by continuing on its previous path of working with a handful of lesser-known manufacturers — namely Fossil Group and Mobvoi. It had no choice but to make drastic changes to its wearables strategy, first by purchasing Fitbit and second by partnering with Samsung.

Do people really love the watch, or was it pent-up demand?

Jitesh Ubrani, research manager for IDC's worldwide device tracker, says it's a bit of both.

"The watches have been well received, and due to the pandemic, there has been additional demand for smartwatches (either as health tracking devices or simply because consumers have extra disposable income," he says.

IDC's data, which is slightly similar to Counterpoint's, indicates that Wear OS's market share grew to 10.9% in Q3 2021, up from 1.9% in the same period a year ago.

Mishaal Rahman, senior technical editor at Esper and former editor-in-chief of XDA Developers, agrees with Ubrani, adding that the Watch 4 series was genuinely well-received.

Announced on August 11 and released August 27, the Samsung Galaxy Watch 4 and 4 Classic are available starting at $250 and $350, respectively,

Rahman adds that offering a "Classic" model appealed to many consumers who prefer a more traditional watch design, and Samsung was smart to offer both models in two sizes.

"The Galaxy Watch series has already seen success in the past (with Samsung taking the #2-3 spot in global smartwatch shipments), so Samsung has already been established as a premium smartwatch brand," he says. "I can't see Samsung slowing down its smartwatch development efforts. Device makers like Samsung see an opportunity in the smartwatch to lock users into their ecosystem. This is why Samsung aggressively bundles its smartphones with its smartwatches and wireless audio accessories, as well as why certain smartwatch features won't work unless the smartwatch is paired to a Samsung phone or tablet."

Growing Wear OS market share doesn't mean a growing demand for Wear OS

Though Ubrani isn't certain if the increase in market share means there is a growing interest in Wear OS.

It is unclear if there's growing interest in Wear OS at this moment. Yes, the OS has seen tremendous growth, but that speaks to Samsung's prowess rather than Wear OS's. It is also worth pointing out that the growth is coming from a very small base. Not only was Q3 2020 a bad quarter as brands were struggling with the onset of the pandemic, but at the same time, the largest players for Wear OS were Fossil and Mobvoi, who ship a fraction of Samsung's volumes in any given quarter. The growth in the latest quarter is because Samsung does a great job at selling smartwatches, and it's unlikely because consumers were clamoring for the latest Wear OS device. — Jitesh Ubrani, IDC

Rahman says that it's not an indication of growing consumer interest in Wear OS, and that's partly because the "average consumer does not care about the underlying operating system of a smartwatch." Instead, most consumers care about aspects such as the design, band materials, band options, health features, among other things, he says.

He says the numbers are indicative of Samsung's successful launch of the watch, which was announced earlier than Apple's Watch Series 7.

"On the other hand, the growth of Wear OS will surely garner attention from major app developers. As Wear OS has gained in market share, more developers will find it worthwhile to devote time and resources into developing apps for the platform," he says.

More manufacturers are going to adopt Wear OS

Rahman says that the momentum to see more manufacturers adopt Wear OS in the future is here. That being said, operating system development is difficult and expensive, he notes, "which is why many smartwatch makers currently opt for making a custom simple [Real-Time Operating System]."

"As a result, these smartwatches lose out on third-party app support from big players like Spotify, Strava, etc. This is because manufacturers usually do not provide app development tools or SDKs to develop for the platform. Furthermore, major app developers do not see much benefit in supporting a platform-specific to a particular device unless that device has significant market share," he says.

There is a significant opportunity for the Chinese OEMs to adopt Wear OS. — Neil Shah, Counterpoint Research

Neil Shah, vice president of research at Counterpoint Research, agrees with Rahman, adding that many Chinese OEMs "have been shy of adopting" and have opted for a forked Android or proprietary lower-power RTOS "to keep the costs, features for a sub-$100 smartwatch."

But the shift will now take place for those same Chinese OEMs who want to opt for creating a premium smartwatch experience above $150.

"There is a significant opportunity for the Chinese OEMs to adopt Wear OS. Further, with Google getting more interested in hardware, a Pixel Watch would potentially drive some interest further for the Wear OS watches in the future," he says.

Over the weekend, we also may have just gotten our first look at the potential Pixel Watch, which has long been nothing but a distant rumor.

Ubrani notes that it's also possible that we might see a Fitbit branded device running Wear OS.

"We may also see additional smartphone brands launch devices, but I'm cautiously optimistic because Wear OS has been through similar transitions in the past with limited success, and I imagine many vendors will take the wait-and-see approach," he says.

Source: androidcentral